The Four Types of Financial Advisors

Which one should you work with?

We find that, by and large, people seeking financial advice know to look for a financial advisor who has high levels of integrity and who wants to do what is in their clients’ best interest at all times.

But it seems that fewer people pay attention to the orientation of their financial advisor candidates. As a result, they may risk choosing an advisor who isn’t a great fit.

Here’s a look at four different types of advisors you are likely to encounter and how they stack up against each other in some key areas. Armed with this information, you should be able to better assess which type is best suited for you based on factors such as your goals, the complexity of your financial situation and your net worth.

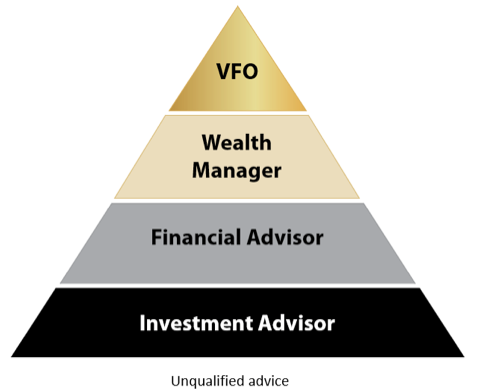

The wealth management hierarchy

The wealth management hierarchy below illustrates the range, depth and breadth of the financial solutions you can get from different types of advisors.

Let’s examine each group.

1. Investment advisor.

A good way to think about the wealth management hierarchy is that it’s progressive, or additive. We start with the base. Investment advisors are excellent financial professionals who do a very good job managing money—but that’s all they do.

While investment advisors provide a single solution—money management—that one solution can have multiple variations (from securities to investments in private companies, real estate, artwork and so forth).

If all you want is someone who manages your money well—positions your investment capital, reallocates it as needed and so on—you can stop at this level. If you want or need expertise beyond money management, you’ll need to move up the wealth management hierarchy.

2. Financial advisor.

When you move to the next level of the wealth management hierarchy, more types of expertise are available to you. Like investment advisors, financial advisors are primarily focused on delivering money management services and products. However, they also provide some wealth planning services.

The wealth planning capabilities of financial advisors tend to be relatively basic and fall within a fairly narrow range of expertise. This typically makes them appropriate for individuals and families with lower levels of complexity in their financial lives. Again, if your financial situation is not complicated, an expert financial advisor may be what you need to pursue the types of outcomes you want.

Next, let’s look at the two highest levels of the hierarchy and the value they bring.

THE HIGHEST LEVELS OF ADVICE

3. Wealth manager.

If you work with a wealth manager, you also can get excellent money management services along with planning services. However, the level of services you will receive will be elevated because wealth managers and their teams can address truly complex situations requiring multiple specialties.

The biggest difference we see between financial advisors and wealth managers is that the latter can typically deliver a more extensive and in-depth range of wealth planning expertise. That expertise might include income tax planning, cross-border planning and financial life management planning.

Wealth managers also tend to offer greater coordination of solutions to address their clients’ financial issues and concerns. For example, a client’s tax-mitigation plan might be informed by his or her charitable giving strategy along with his or her eventual wealth transfer desires. As a result, none of the strategies work against or conflict with the others.

Working with a wealth manager will indeed get you most of the best solutions that will enable you to achieve a well-structured financial world.

4. Virtual family office.

The pinnacle of the wealth management hierarchy is the high-performing virtual family office, or VFO. A VFO incorporates exceptional wealth management with robust attentiveness to administrative and lifestyle matters. High-performing virtual family offices are also able to deal with the important one-off special projects that might arise.

By providing extensive and coordinated solutions that address clients’ financial situation and many aspects of their family’s well-being, a VFO can build and protect personal wealth while also making clients’ daily lives much easier.

Not surprisingly, a high-performing virtual family office is not the right choice for everyone—especially if your needs and challenges are not sufficiently complex. But if you need a level of support and capabilities that goes beyond the other three categories, a VFO could be a good fit.

To see how each category measures up, consider the needs of a hypothetical successful entrepreneur seeking to sell his or her company. The amount a business owner ends up with can depend to a great degree on the expertise received through the sale process (see the chart below).

What Each Type of Financial Professional Can Do When You Sell Your Company

| Type of professional | Pre-sale expertise | Sale expertise | Post-sale expertise | Likely outcome |

| Investment advisor | Not applicable | Not applicable | Limited to money management | After the sale, management of likely fewer assets |

| Financial advisor | Usually minimal, if any | Not applicable | Primarily money management | After the sale, management of likely fewer assets |

| Wealth manager | Varied to extensive | Not applicable | Varied to extensive | Family wealth larger at and after sale |

| High-performing virtual family office | Extensive | Supportive | Extensive | Family wealth maximized at and after sale |

The upshot: The “perfect” financial professional for you and your family depends both on your situation and the level of expertise you need to address your needs, goals, concerns and wants. Keep this hierarchy of wealth management in mind as you meet and assess potential advisors. It could help guide you to the right advisor for you.

As always, standing by if I can be of assistance.

ACKNOWLEDGMENT:This article was published by the VFO Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.